Welcome to the website dedicated to the fourth, fifth and sixth AML directive and IT solutions in Compliance, AML / CFT and Risk Management.

We discuss ways to implement the provisions of the Fourth Directive of the European Parliament and the Council of Europe No. 2015/849 of May 20, 2015 (AML4) and the requirements of the Polish Anti-Money Laundering and Terrorism Financing Act of 1 March 2018 (Journal of Laws 2018, item. 723)

The blog covers the following topics:

- Implementation of risk analysis procedures by the Relevant Persons / Obligated Institutions

- Customer Due diligence (CDD)

- Know Your Customer (KYC)

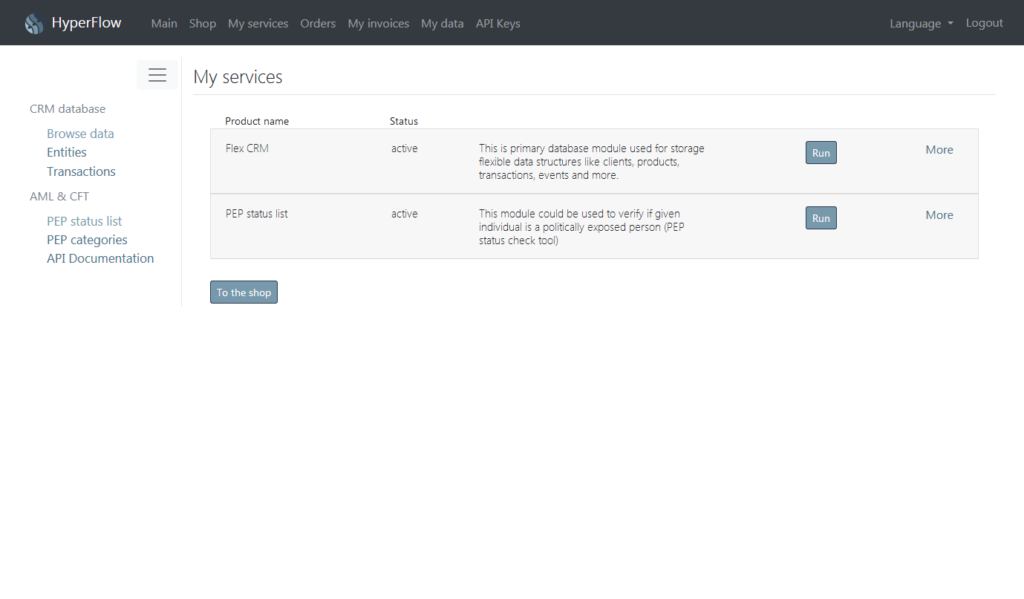

- The range of available IT tools allowing to streamline AML processes.

- Analysis of related transactions

- Searching for the actual beneficiary (UBO)

- PEP tools (People on prominent political positions and RCA – families and close associates)

- The role of AI in anti-fraud systems – advantages & threats

- Fifth AML Directive (AMLD5) of 30 May 2018

- Sixth AML Directive (AMLD6) of 28 October 2018

All AML EU Directives summary

| Directive Number | Official Number | Key Details | Date of Implementation End |

|---|---|---|---|

| AMLD 4 | Directive (EU) 2015/849 | Strengthened the EU’s AML framework, introduced risk-based approach, and enhanced transparency of beneficial ownership. | June 26, 2017 |

| AMLD 5 | Directive (EU) 2018/843 | Expanded the scope to include virtual currencies, prepaid cards, and enhanced cooperation between Financial Intelligence Units (FIUs). | January 10, 2020 |

| AMLD 6 | Directive (EU) 2018/1673 | Focused on harmonizing the definition of money laundering offenses and increasing penalties for money laundering crimes. | December 3, 2020 |

| AMLD 7 | Directive (EU) 2024/1640 | Further strengthened mechanisms to prevent money laundering and terrorist financing, including enhanced due diligence measures and improved cooperation between member states. | June 30, 2025 |